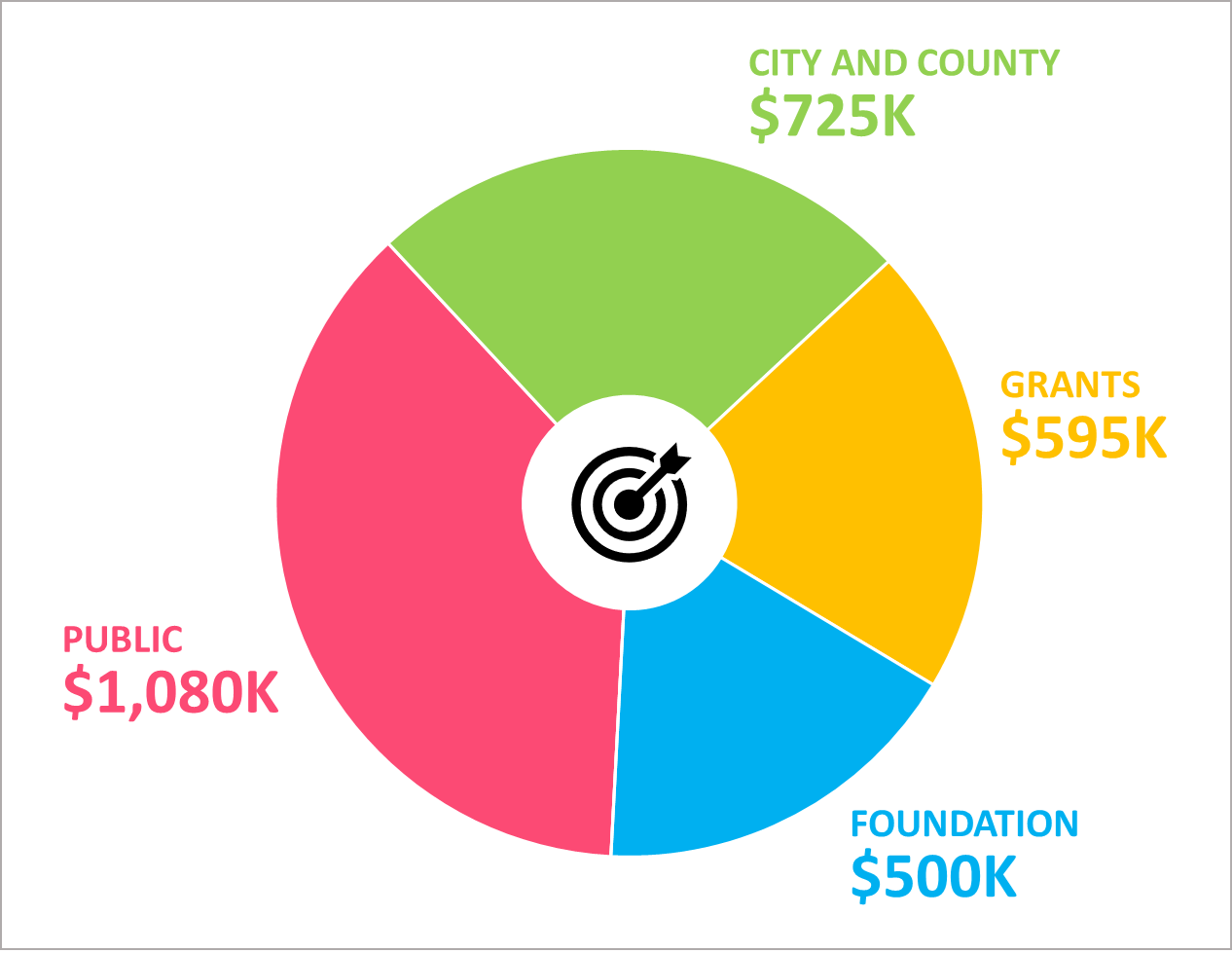

To make renewal a reality, we need your help. We've had tremendous support from donors – big and small – and have already surpassed our original fundraising goal. However, dramatic growth in labor costs has increased the project’s overall budget, and we need to continue our fundraising progress to renew our much-loved Waverly Public Library. Your tax-deductible gift toward this goal is critical and will help keep our Library vibrant for years to come.

Campaign donations are made to the Waverly Public Library Foundation, which provides financial development for the Library and manages the gifts it receives. A major portion of the Foundation’s past gifts has already been committed to this project.

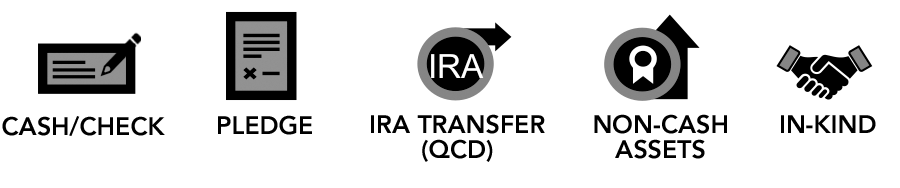

To support this renewal, you can make a one-time cash gift or a multi-year pledge or transfer a qualified charitable distribution (QCD) from your IRA. You can also contact us to discuss a non-cash gift of appreciated stock or real estate, or an in-kind donation of services. Pledge forms can be picked up at and returned to the Waverly Public Library.

Every gift helps!

WAYS TO GIVE

All donations will be directed to the Waverly Public Library Foundation. Monetary gifts to 501(c)(3) charitable organizations are tax-deductible to the extent allowed by law. Visit with your financial advisor to learn more. All donations will be used by WPL for the highest and greatest campaign need. WPL retains the right to accept or deny all contributions. Periodic recurring gifts (i.e., monthly, quarterly) can be made by a credit card via the website giving page.

| GIVING LEVEL | AMOUNT |

|---|---|

| Pinnacle | $100,000 and up |

| Legacy | $50,000 - $99,999 |

| Foundation | $15,000 - $49,999 |

| Impact | $5,000 - $14,999 |

| Community | $1,000 - $4,999 |

| Friends and Family | Up to $999 |

EVERY GIFT COUNTS

There’s no minimum and 100% of your gift will go toward Library renewal. All gifts will be recognized on our donor wall. For 25 years, Waverly Public Library has worked hard to support community togetherness and life-long learning! Will you help us as we look to the next 25?

QCDs SIMPLIFIED

A qualified charitable distribution, or QCD, allows individuals age 70½ or older to donate up to $100,000 each year to one or more charities directly from a traditional IRA. Amounts distributed as a QCD can be counted toward satisfying annual required minimum distributions (RMDs).

By making a gift from an IRA to the Library Foundation, donors reduce their taxable income by the amount of the QCD and may avoid being pushed into a higher tax bracket. Be sure to consult your tax professional for the benefits and limitations that apply to your personal situation, and contact us for Foundation tax ID info to include on your IRA paperwork.